Retain And Increase The Value Of Your Apartment Investment

A fundamental goal to insure the long term survival of your apartment investment is to retain and increase its value. Warren Buffett once said: “First rule of investing… Don’t lose money”. This is a rule that every investor should regard as the number one rule of investment.

When you relate this to apartment investment, there are two key pillars of value that you need to understand and focus on in order to support your investment:

- Capitalization Rate or Cap Rate

- Net Operating Income or NOI

These two pillars will be two of the major determinants of how well you retain and increase the value of the apartments that you have invested your time and money into.

Capitalization Rate

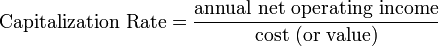

The Capitalization Rate or Cap Rate is the ratio between the net operating income produced by an asset and its capital cost (the original price paid to buy the asset) or alternatively its current market value. The rate is calculated in a simple fashion as follows:

The Capitalization Rate is defined as the unleveraged annual cash return (as a percentage) for the property before any debt service or capital improvements. So, if you purchased an apartment building for $4,000,000 and it is an 8.0 Cap Rate, you would expect to make $320,000 per year in Net Income.

One analogy is that Capitalization Rates are a lot like average price per square foot ranges on residential homes. Depending on the location and amenities, the same exact home will have completely different price per square foot values and corresponding home price.

The analogy holds true for Capitalization Rates.

The exact same property in different markets and in different physical condition can have a materially different capitalization rate range.

The Cap Rate can therefore be seen as “The Market” and the investor has very little control over what the capitalization rate will be in any given area.

On the flip side of the coin, the investor is largely in control of the Net Operating Income or NOI.

Net Operating Income

Net Operating Income is the Gross Income, which is rents plus other income less any vacancy and collection loss, minus the operating expenses, not including any debt that may be associated with the property.

This Net Operating Profit is the free cash flow the property provides before paying any debt.

In other words, take any two buildings of the same age, location, and condition. The Better asset is the property with the larger Net Operating Income.

Apartment buildings can basically be seen as independent small businesses. By improving operations, such as marketing, leasing, expense management, collections, etc., you can increase the value of the property.

Here are two key points that you should keep in mind:

- Capitalization Rates move very slowly if at all, especially in multifamily apartments. This is great for reducing volatility and increasing predictability.

- For multifamily apartment investments, Capitalization Rates typically are range based (e.g. 5.0 to 6.0 or 7.5 to 8.5). This is helpful because even if the Capitalization Rate in your market increases after purchase, you can increase the Net Operating Income enough to compensate for the change and still increase both cash and equity value obtained from the property.

The following process found below is a guideline on how you can protect your invested equity and develop permanent wealth.

- Find the best markets for multifamily investing.

- Either be or work with the best Asset Managers you can.

- Find the best operators (professional, certified, fee-based property management).

- Find the best submarkets and neighborhoods.

- Purchase the best asset for your strategy.

- Improve Net Operating Income and maintain your capital investments.

- Collect tax-advantaged cash flow month after month.

By using this process you can make sure that you get the most out of every aspect of your apartment investment.