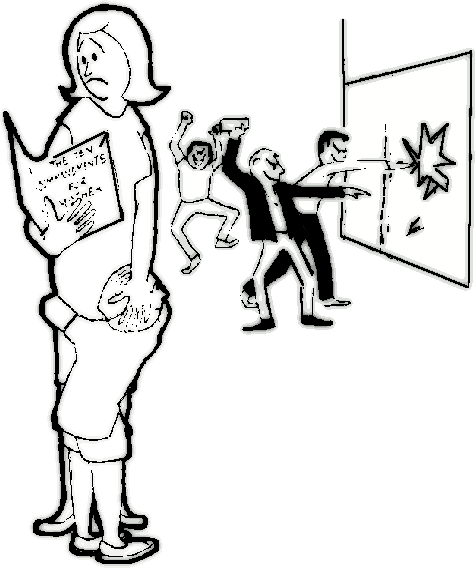

Have you considered the advantages of business property insurance? Here’s why: On July 29th in Hamilton City, California, a small business which combines a Shell gas station and a Subway Sandwich Shop was robbed and vandalized, costing thousands and thousands of dollars in stolen and damaged stock. Because police were understaffed at the time the alarm went off at 2:38 a.m., they were unable to respond to the scene until after 3 a.m., allowing the criminals ample time to smash and grab. Police found the glass front door shattered. Items missing from the store included alcohol, food, tobacco products…and Tylenol Unfortunately, the thieves and vandals weren’t the only ones suffering from a major headache the next day. In the end, officials estimated the loss to be considerable. At least $13,000.

The Insurance Family Blog

Susie Scherff

Recent Posts

Hamilton City, California Business Loses Thousands In Stock After Burglary And Vandalism

Posted by Susie Scherff on September 15, 2011 at 10:18 AM

Topics: Business Insurance, Building Insurance

There’s One In Every Bunch: Protecting California Restaurants Against Employee Dishonesty

Posted by Susie Scherff on September 14, 2011 at 1:46 PM

It’s a cynical statement…that there’s one in every bunch. But we’ve all been in work situations where one employee’s dishonesty negatively affects the entire staff…and your bottom line. However, there are steps you can take to reduce employee dishonesty and crime in your restaurant, and restaurant insurance is a major part of that.

Topics: Business Insurance, restaurant insurance

California Earthquake Loss Assessment – Is My Condominium Covered?

Posted by Susie Scherff on September 13, 2011 at 11:42 AM

Do you know what your condominium insurance covers in case of an earthquake? There are some vague areas of understanding, so we thought we would take a moment to explain what you need to know in case of such a scenario.

Topics: Business Insurance, Condominium Insurance, Earthquake Insurance

The Impact Of Hurricane Irene On The National Flood Insurance Program

Posted by Susie Scherff on September 12, 2011 at 1:50 PM

Will flooding from Hurricane Irene prompt Congress to speed along the process to reauthorize the National Flood Insurance Program? That is what property and casualty trade representatives are hoping. The program is slated to expire the 30th of this month. The problem is the conflict between Congress and the Senate. The House passed a bill (HR1309) which would extend the program for 5 years and make rates sound, while the Senate has profoundly different views on how to proceed.

Topics: Insurance, Flood Insurance

California Business Owners Insurance Policies: Working For Longevity

Posted by Susie Scherff on September 8, 2011 at 11:35 AM

Getting the most out of your business means being creative with whatever it is you’re doing, with making your company a rewarding place of employment for your staff and, of course, maximizing those profits. It’s a pursuit of both passion and practicality. So it’s something you want to protect with everything you’ve got. You put your heart, mind and soul into making it work…shouldn’t you do the same to sustain it? A business owner’s insurance policy helps you to attain that goal.

California Business Owners: Are You More Vulnerable To Lawsuits Than You Think?

Posted by Susie Scherff on September 7, 2011 at 11:53 AM

California restaurateurs should be concerned about possible legal actions that can leave your cherished business crippled. Have you really evaluated all of your risks involved with owning a restaurant? There are so many to consider, including business insurance to protect your company.

Topics: Business Insurance, California Restaurant Association

When setting up any business, it is vital that you choose the most appropriate, most beneficial, and most cost effective insurance solution to cover all of your needs. Each business and every industry has its own unique requirements because of the day to day activities involved in that business. Running a restaurant, for instance, requires liability insurance for employees and for customers. However, there are some aspects of restaurant insurance that you may not have yet considered. Fortunately, restaurant insurance can be tailored to meet all of the needs of restaurants, coffee shops, delis, bistros and similar businesses.

Topics: Business Insurance, restaurant insurance, Insurance

Restaurant Insurance: Keep Food Costs To A Minimum & Expand Profits

Posted by Susie Scherff on August 31, 2011 at 9:30 AM

Do you want to increase your restaurant or bistro’s profits? Of course you do. So have you been keeping tabs on how much food goes bad during a specified amount of time and found that you’re dealing with an inordinate amount of spoilage? As a restaurateur you know it’s imperative that you keep a lid on food costs…especially food that goes bad during a given week. That said, it’s always good to check that your California restaurant insurance policy includes coverage for unforeseen food spoilage, as sometimes it’s unavoidable. Nevertheless, keep our guide to minimizing food spoilage in mind when organizing your kitchen.

Topics: Business Insurance, restaurant insurance

New Legislation May Give Benefits To Continuous Car Insurance Holders

Posted by Susie Scherff on August 30, 2011 at 9:30 AM

Back in 2010, legislation was proposed that would reward car insurance consumers for maintaining continuous coverage with discounts to their premiums, no matter who they had their coverage with. That legislation failed to pass.

Topics: Auto Insurance, Insurance, Commercial Auto Insurance, Car Insurance

Liquor Liability Insurance for Your Restaurant – Are You Covered?

Posted by Susie Scherff on August 29, 2011 at 9:30 AM

Coverage

Liquor Liability Insurance for California restaurants and bars defends you against any charges of negligence related to the service of alcohol on your premises, and also indemnifies your business for any financial loss if you are found to be legally liable for any negligence. As the owner, you are responsible for your patrons when alcohol is served to them under California’s Liquor Liability laws.

Topics: Business Insurance, restaurant insurance, Insurance